The PresentValueToAnnuity built-in Glb.Financial method calculates the present value required to produce the annuity for the specified number of time units, leaving a future value of zero.

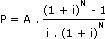

The following calculation is used:

Refer to Glb.Financial Built-In Methods for more information on designations used in this calculation.

Failure behavior

The PresentValueToAnnuity method can return an inconsistent result if an error occurs. The Glb.Status built-in segment attribute should be verified before the result is used.

If assigning the result to a signed number-primitive variable, truncation of significant digits occurs without warning if it is not of a sufficient length.

Syntax

Glb.Financial::PresentValueToAnnuity( annuity : numericExpression, interestRate : numericExpression, timeUnits : numericExpression) : numericLiteral

Owner

Glb.Financial.

Return type

A number-primitive, length and decimal properties of which can vary. As a guideline, the internal intermediate work files are stored as USAGE COMP-2, and rounded on output.

Parameters

annuity

A numeric expression specifying the annuity payment, A. This expression is assumed to be of length 12, with 3 decimal places. If this expression that does not have these property values, it should be ensured that truncation of significant digits does not occur.

interestRate

A numeric expression specifying the interest rate percentage, i, to be applied per time unit. This expression is assumed to be of length 10, with 8 decimal places. It must be positive and is interpreted as a percentage.

timeUnits

A numeric expression specifying the number of time units, N. This expression is assumed to be of length 12, with 6 decimal places.